There are two major considerations in the timing of buying a home, your personal needs and desires, and the market conditions.

Personal Considerations:

Stability: Do you have job, income and financial stability? Given the financial issues of the last few years, job and income stability will be mandatory with lenders.

Will you be planning on staying in the general area for at least 3 to 5 years? The risk of market timing is diminished if this is a long-term commitment and investment.

Are your personal circumstances likely to change? This is a key consideration, as family size and needs are one of the biggest reasons for moving. Will you be adding to your family size or perhaps transitioning to empty nesters?

Can you afford a home that meets your current and projected needs? If you can not find one in the location you desire, are you flexible in your commuting distances to find a home that meets your needs?

Market Conditions:

Market Timing: This is a difficult determination to make. What is the projection for the cycle to be--upward or downward?

Mortgages: The lower the interest rates, the more affordable the home. A 30-year fixed mortgage is a wonderful thing! The basic payment does not change with inflation, so as home prices increase, the payment is locked in. The second question is “Are there safe mortgages available for my needs?”

Inventory: Is there an adequate inventory of homes available to make a selection?

Special Considerations: Are there opportunities for special mortgages or programs for which you can qualify? As an example, there are first-time homebuyer mortgage programs, restricted-income mortgage programs, and special tax credits available for some buyers.

The Current Market Considerations:

This is a great time to buy from a market perspective. Prices have fallen, and they are now in line with historic average appreciation. The market transactions have bottomed, and prices are probably near the bottom of the market. Most real estate and economic experts believe the housing market will recover with the economy, and that the recession is, technically, over. There is still an adequate inventory of homes that are listed, left over from the housing recession, and interest rates continue to be at the lowest levels in four decades. There are tax credits for first time homebuyers, and for home sellers that have lived in their home for more than five years.

Consider this information: (From National Association of Realtors®)

Most Americans still believe buying a home is a good investment. Nine out of ten consumers consider homeownership to be a sound decision.

Given the leverage in purchasing a home, the average return on a 5 percent down payment over 10 years is usually three to five times greater than stock market returns.

Another advantage of owning a home is the ability to “write off” the mortgage interest on your taxes, thus reducing your federal income tax bill, and thus saving additional dollars.

If you bought a home 10 years ago, it would be worth almost 27 percent more today.

Real estate has delivered the best return of any investment over the last 40 years.

The typical homeowner’s net worth ($205,200) was 49 times that of the typical renter ($4,200) in 2009, according to NAR calculations using statistics from the Federal Reserve Board.

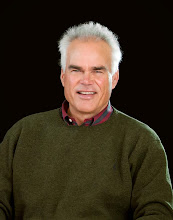

You can reach me, Don Ricedorff, at The Wells Group, Durango, Colorado, 970-375-7014 or don@durangorealproperty.com

Don Ricedorff is a licensed real estate broker in the State of Colorado, with 16 years of experience, and he resides in Durango Colorado.He has numerous real estate designations, which have provided him with an unparalleled education to assist his clients.

The designations include:

CRS, Certified Residential Specialist

CRB, Certified Residential Broker

CCIM, Certified Commercial Investment Member

CDPE, Certified Distressed Property Expert

ABR, Accredited Buyer Representation

GRI, Graduate of Realtor Institute

RSPS, Resort and Second Home Property Specialist

CIPS, Certified International Property Specialist

SRES, Senior Real Estate Specialist

He is also an active volunteer in the community and his church. His highest aspiration is spending time with his wife, Janet, and his three children Kelly, Katie, and Kyle. His other interests include playing tennis, fly fishing, hiking, boating, and water skiing.

Tuesday, January 19, 2010

Subscribe to:

Comments (Atom)